AMP Bank boosts broker ties with digital innovation

IN Partnership with

With over 90% of its lending business coming via brokers, AMP Bank is investing in technology, products and partnerships to set new standards for broker support in a shifting mortgage market

More

AMP BANK is proudly making brokers the centrepiece of its distribution strategy, investing in digital innovation, personalised support and business solutions to ensure brokers – and their customers – feel the benefits. AMP Bank has a long-standing commitment to brokers based on the belief that they offer unmatched value in helping customers navigate complex lending decisions.

�“Australians want trusted guidance and genuine choice for major financial decisions. That’s what brokers deliver – and it’s why AMP Bank has backed the channel from day one,” says Michael Christofides, director of lending and everyday banking. “Today, more than 90% of our home loans are originated through brokers.”

�For AMP Bank, this broker-first approach reflects a deep understanding of what customers value most in their financial journey. “Brokers offer unmatched value in helping customers navigate complex lending decisions,” Christofides says. “The growing popularity of brokers is the strongest possible endorsement from customers themselves. It reflects a clear preference for personalised advice, transparency and choice – all of which brokers are uniquely positioned to provide.”�

AMP Bank is a non-major digital bank that’s been operating for over 25 years, providing Australians with home loans and deposit and transaction accounts. We take pride in our strong service aimed at making it easy for brokers to do business with us, and ensuring customers have a positive banking experience. At AMP, we’re here to help people create their tomorrow, and we value brokers’ role in achieving this, supporting clients to make some of life’s largest financial decisions.

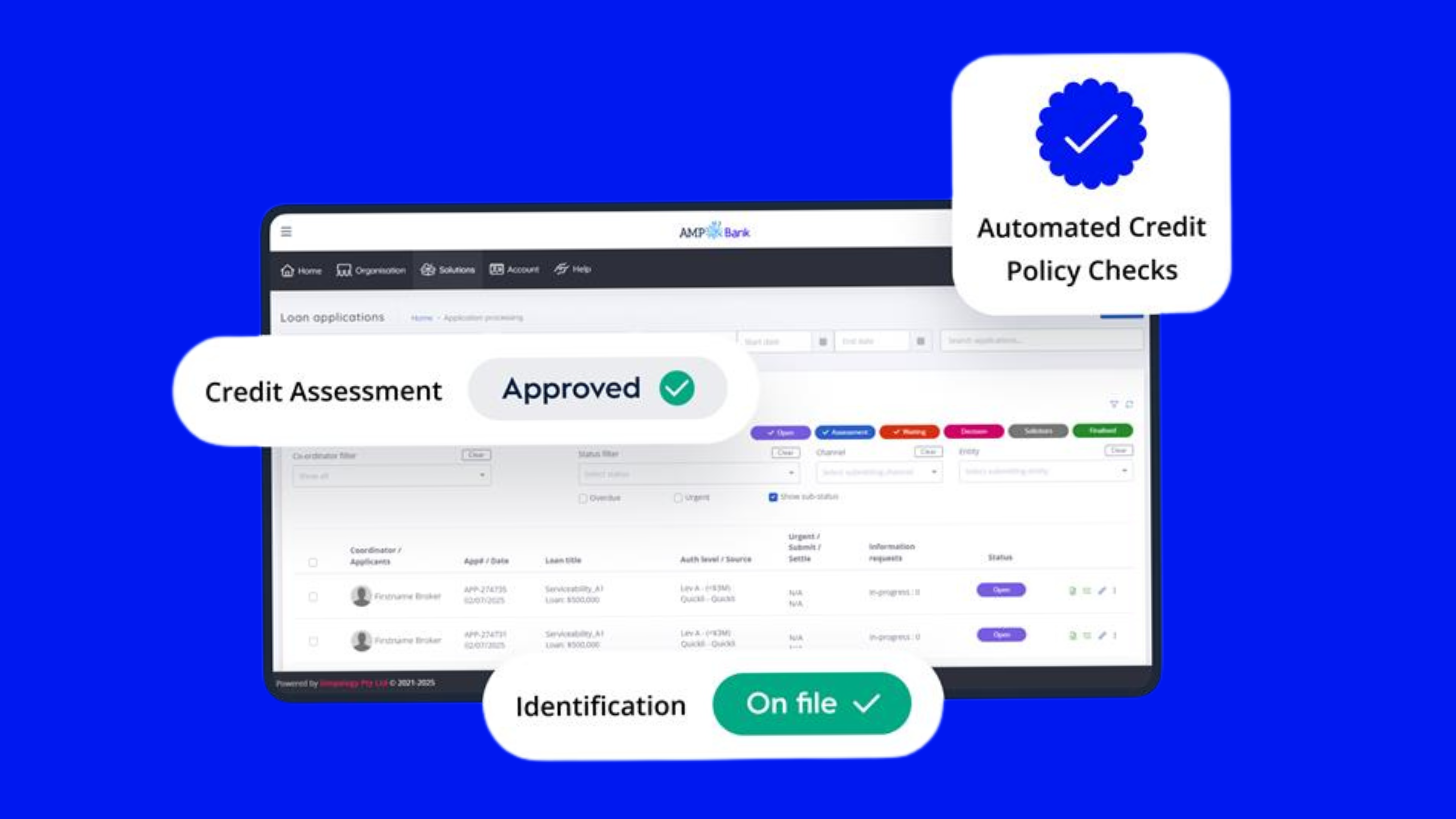

AMP Bank broker platform driving faster outcomes

Real-time credit and policy checks

“Australians want trusted guidance and genuine choice for major financial decisions. That’s what brokers deliver – and it’s why AMP Bank has backed the channel from day one”

Michael Christofides,

AMP Bank

At the centre of AMP Bank’s broker strategy is its new loan origination platform, developed and custom built with direct input from brokers and leading fintechs. The platform is designed to tackle long-standing pain points and streamline the mortgage process.

�“Purpose-built for broker workflows, the platform uses the latest technology to remove friction, improve visibility and deliver faster, more confident outcomes for both brokers and customers,” Christofides says.�

Notable features include:

�

Broker collaboration has been at the heart of the platform’s design, from initial advisory groups and pilot programs to regular feedback forums. “We didn’t build something for brokers and ask for feedback – we built it with them at every step,” Christofides says.

�Brokers helped define system workflows, test prototypes and even refine platform language. Feedback loops, including in-platform sentiment signals, continue to guide release cadence. Key features – such as mandatory fields, interface design, income verification options and tooltips – were broker driven. Support tools for broker teams were also prioritised based on broker input.�

This collaborative approach extends to training and support. AMP Bank’s dedicated training hub offers live webinars to help brokers become super users in 90 minutes; two 30-minute deep dives on digital income verification and supporting documentation; bite-sized reference guides and self-paced videos; and live chat support via Simpology, including screen sharing for instant issue resolution.

�“Our goal is to deliver a true business partnership – from platform launch to settlement and beyond,” Christofides says.�

“In a competitive market, this mix of certainty, speed and broker-first design is what sets us apart,” Christofides says.

Share

Technology built for brokers, with brokers

Ongoing partnership and feedback

Published 01 Sep 2025

Share

“Purpose-built for broker workflows, the platform uses the latest technology to remove friction, improve visibility and deliver faster, more confident outcomes for both brokers and customers”

Michael Christofides,

AMP Bank

Verification of income, ID and property before submission

Personalised borrower videos delivered automatically

CRM integration eliminates double data entry

Live chat and screen share support for instant help

By leveraging equity in a broker’s recurring revenue, not just personal assets

How AMP Bank’s Business Finance Loan helps brokers grow

By providing a flexible line of credit, enabling brokers to:

acquire or merge with other businesses

implement succession plans

support shareholder buy-ins

invest in staff

manage cash flow and GST obligations

Beyond technology, AMP Bank is also supporting brokers with its business finance loan – a flexible line of credit secured against recurring revenue, not just personal assets. This product is designed to help brokers grow by providing capital to acquire or merge with other businesses, implement succession plans, support shareholder buy-ins, invest in staff, or manage cash flow and GST obligations.

�The impact is tangible. One broker used the loan to enable a family succession plan, allowing a daughter and key employee to acquire shares without mortgaging personal property. Another used it to facilitate a merger and bring younger brokers into ownership without liquidating assets. Others have expanded by acquiring trail books and recruiting new brokers, all while maintaining financial stability.

�“Ultimately, our business finance loan empowers brokers to think strategically, scale their business and plan for the future with confidence,” Christofides says.�

Business finance for broker growth

AMP Bank recognises that brokers work across time zones and have different learning styles and busy lives. That’s why its anywhere, anytime training model gives brokers the flexibility to learn when and how it suits them, so they can focus on what matters most: growing their business and supporting customers.

Flexible training to fit broker lifestyles

What sets AMP Bank apart

Broker feedback has also driven recent product and policy changes, such as the introduction of a 10-year interest-only loan – the first of its kind from an Australian bank, with no midterm reassessment. This is available to investors, owner-occupiers and retirees. AMP Bank has also enhanced self-employed assessment, simplifying documentation and increasing recognition of bonus and rental income.

�“These changes simplify income verification, reduce complexity and help more customers create wealth through property,” Christofides says. “They’ve also led to improved conversion rates and stronger broker engagement.”�

Listening and responding to broker needs

AMP Bank combines the strength of a traditional lender with the agility of a challenger. Brokers consistently cite AMP Bank’s channel alignment (over 90% of loans via brokers, with no channel conflict), decisioning transparency through real-time dashboards and direct access to credit specialists, and innovation that removes friction – from extended interest-only and business lending to digital verification and personalised customer communications.

�The bank’s reliable mortgage platform offers both customers and brokers real-time visibility into the home loan application process, with adaptable products and policies to help customers reach their property goals. ��

The AMP Bank Lender Platform is rolling out nationally from 14 August, supported by an extensive training hub (accessible now) featuring webinars, guides and videos. Looking ahead, AMP Bank is focused on continuously improving the broker experience through ongoing feedback, by bringing brokers closer to the decision and by reusing broker data wherever possible and expanding small business capability – including scenario modelling and broker-branded SME education assets.

�While automation and digital tools continue to evolve, AMP Bank remains committed to the human layer. Business development managers will continue to play a vital role in training, support and relationship building.

�“We’re the bank that brokers can bank on,” Christofides says.

Ongoing investment in broker partnerships

Companies

People

Newsletter

About us

Authors

Privacy Policy

Conditions of Use

Terms & Conditions

Contact Us

Sitemap

RSS

Copyright © 1996-2025 KM Business Information Australia Pty Ltd.

Resources

TV

News

Specialty

Best in Mortgage

Mortgage Industry

US

CA

AU

NZ

UK

“These features aren’t just tech upgrades – they’re strategic investments in brokers’ businesses. Every feature was shaped by broker feedback. AMP Bank is in the broker channel for the long haul, and we’re backing that up with action,” Christofides says.

upfront digital verification of income, ID and property data, providing confidence before submission

real-time credit and policy checks that flag issues instantly, reducing rework and delays�

DocuSign loan documents issued in 90 seconds, helping customers secure their homes faster�

personalised borrower videos with key contract details and settlement guidance�

CRM integration, ensuring seamless data flow and eliminating duplication�

advanced fraud detection and automation powered by fintech partners for accuracy and security

Find out more

Companies

People

Newsletter

About us

Authors

Privacy Policy

Conditions of Use

Terms & Conditions

Contact Us

Sitemap

RSS

Copyright © 1996-2025 KM Business Information Australia Pty Ltd.

News

MORTGAGE INDUSTRY

BEST IN MORTGAGE

SPECIALTY

TV

Resources

US

CA

AU

NZ

UK

Companies

People

Newsletter

About us

Authors

Privacy Policy

Conditions of Use

Terms & Conditions

Contact Us

Sitemap

RSS

Copyright © 1996-2025 KM Business Information Australia Pty Ltd.

News

MORTGAGE INDUSTRY

BEST IN MORTGAGE

SPECIALTY

TV

Resources

US

CA

AU

NZ

UK